Estate Planning Attorney Things To Know Before You Get This

Estate Planning Attorney Things To Know Before You Get This

Blog Article

The Ultimate Guide To Estate Planning Attorney

Table of ContentsThe Best Guide To Estate Planning Attorney7 Simple Techniques For Estate Planning AttorneyNot known Details About Estate Planning Attorney The Definitive Guide to Estate Planning Attorney

Estate planning is an activity plan you can make use of to determine what happens to your assets and responsibilities while you live and after you pass away. A will, on the various other hand, is a lawful record that outlines exactly how possessions are dispersed, that looks after youngsters and family pets, and any type of other wishes after you pass away.

The executor additionally has to settle any kind of taxes and debt owed by the deceased from the estate. Lenders typically have a limited amount of time from the date they were informed of the testator's death to make insurance claims versus the estate for money owed to them. Cases that are rejected by the executor can be taken to court where a probate court will certainly have the final say regarding whether or not the claim is legitimate.

Estate Planning Attorney Can Be Fun For Everyone

After the supply of the estate has been taken, the worth of possessions determined, and taxes and financial debt paid off, the administrator will after that look for permission from the court to distribute whatever is left of the estate to the recipients. Any type of inheritance tax that are pending will certainly come due within 9 months of the day of death.

Each individual areas their properties in the trust fund and names someone other than look what i found their spouse as the recipient., to support grandchildrens' education.

How Estate Planning Attorney can Save You Time, Stress, and Money.

Estate organizers can collaborate with the contributor in order to minimize taxable earnings as an outcome of those payments or formulate methods that make the most of the result of those donations. This is an additional approach that can be used to restrict fatality taxes. It involves a specific securing the current worth, and thus tax obligation liability, of their property, while attributing the worth of future growth of that funding to one more person. This technique includes freezing the worth of a property at its worth on the date of transfer. Appropriately, the amount of potential resources gain at fatality is additionally frozen, permitting the estate organizer to approximate their potential tax responsibility upon death and much better prepare for the payment of revenue tax obligations.

If sufficient insurance coverage profits are offered and the plans are effectively structured, any kind of revenue tax obligation on the regarded dispositions of possessions adhering to the fatality of a person can be paid without resorting to the sale of possessions. Profits from life insurance that are received by the recipients upon the fatality of the guaranteed are usually revenue tax-free.

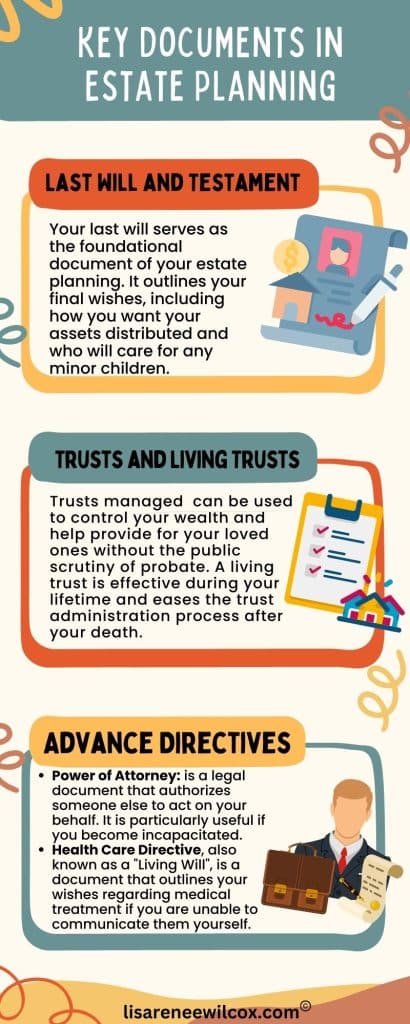

There are specific files you'll require as component of the estate preparation process. Some of the most typical ones include wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is just for high-net-worth individuals. Estate planning makes it easier for people to establish their wishes prior to and after they die.

The Single Strategy To Use For Estate Planning Attorney

You should begin preparing for your estate as quickly as you have any type of quantifiable asset base. It's an ongoing process: as life advances, your estate strategy ought to shift to match your conditions, in accordance with your new objectives. And maintain it. Refraining your estate preparation can trigger excessive financial worries to liked ones.

Estate planning is commonly thought of as a tool for the affluent. Estate planning is additionally an excellent method for you to lay out plans for the treatment of your minor youngsters and family pets and to browse around these guys describe your dreams for your funeral and favorite charities.

Eligible candidates that pass the test will be officially accredited in August. If you're eligible to sit for the exam from a previous application, you may file the brief application.

Report this page